How to Pay Income Tax Online

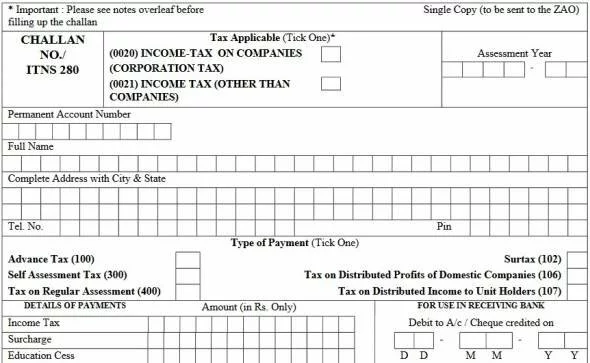

Government June 25, 2016, 0 Comment 52Find step by step guidelines to pay your income tax online. The income tax department offers facility of filing income tax return at the nsdl portal. This post shows you how to pay income tax online. Income tax is paid using challan 280. It is significant to pay your income tax on time to avoid last minute hassles. We have shared step wise procedure to make payment of income tax. The tax payers can pay self-assessment, regular and advance tax payment through this procedure. The tax should be paid regular as per the last dates prescribed by the government.

How to Pay Due Income Tax Online

Follow the below procedure to make income tax payment online:

- Go to the Tax Information Network site of nsdl portal.

- Individuals paying tax should choose the assessment year.

- Enter your PAN card number in the related field.

- Select the option of 100 – Advance Tax Payment if you are paying tax for the current year.

- After filling up all the details correctly you will reach the net banking page.

- Enter the income tax amount you have to pay.

- After successful payment of Income tax return, a receipt known as challan 280 will be generated.

- It will have counterfoil. The challan will carry CIN, and BSR code.

- Preserve the challan to verify the income tax payment at later stage. The CIN number is the proof of your income tax payment.

If you want to verify online income tax payment done by you, view the Form26AS. You can view the Form 26AS at the e-filing official website. The income tax payment you make will be uploaded in the Form 26AS after two to three days. The Form 26AS can be viewed by login the income tax website. It is a statement of all taxes deducted, paid and refunded during the financial year. The income tax e-filing website shows the option to view the Form 26AS at the homepage. You will also see the options to upload the return and check the income tax return status.

Leave a comment